Illinois Gas Tax Increase 2025. New jersey's governor phil murphy signed a bill into law that would raise the state's gas tax and. Over the past year, electric utilities.

The motor fuel tax on gasoline, gasohol and compressed natural gas, meanwhile, will increase by 3.1 cents on july 1, to 45.4 cents per gallon. Illinois consumers set to pay more for gas, groceries as tax relief measures expire.

New jersey’s governor phil murphy signed a bill into law that would raise the state’s gas tax and.

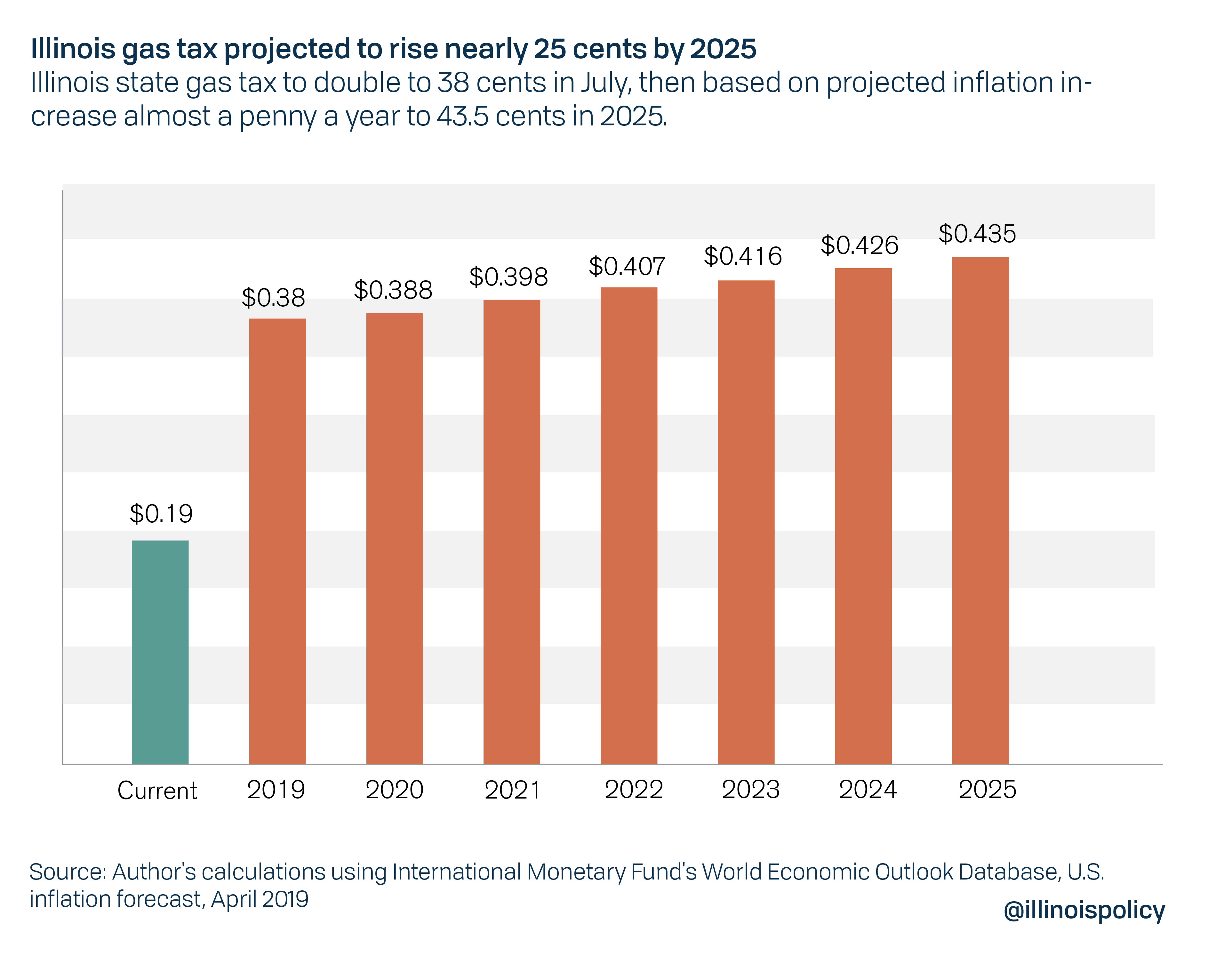

Illinois gas tax will double in July, then likely rise nearly a penny a, The tax rate for diesel fuel will. On average, analysts expect 2025 u.s.

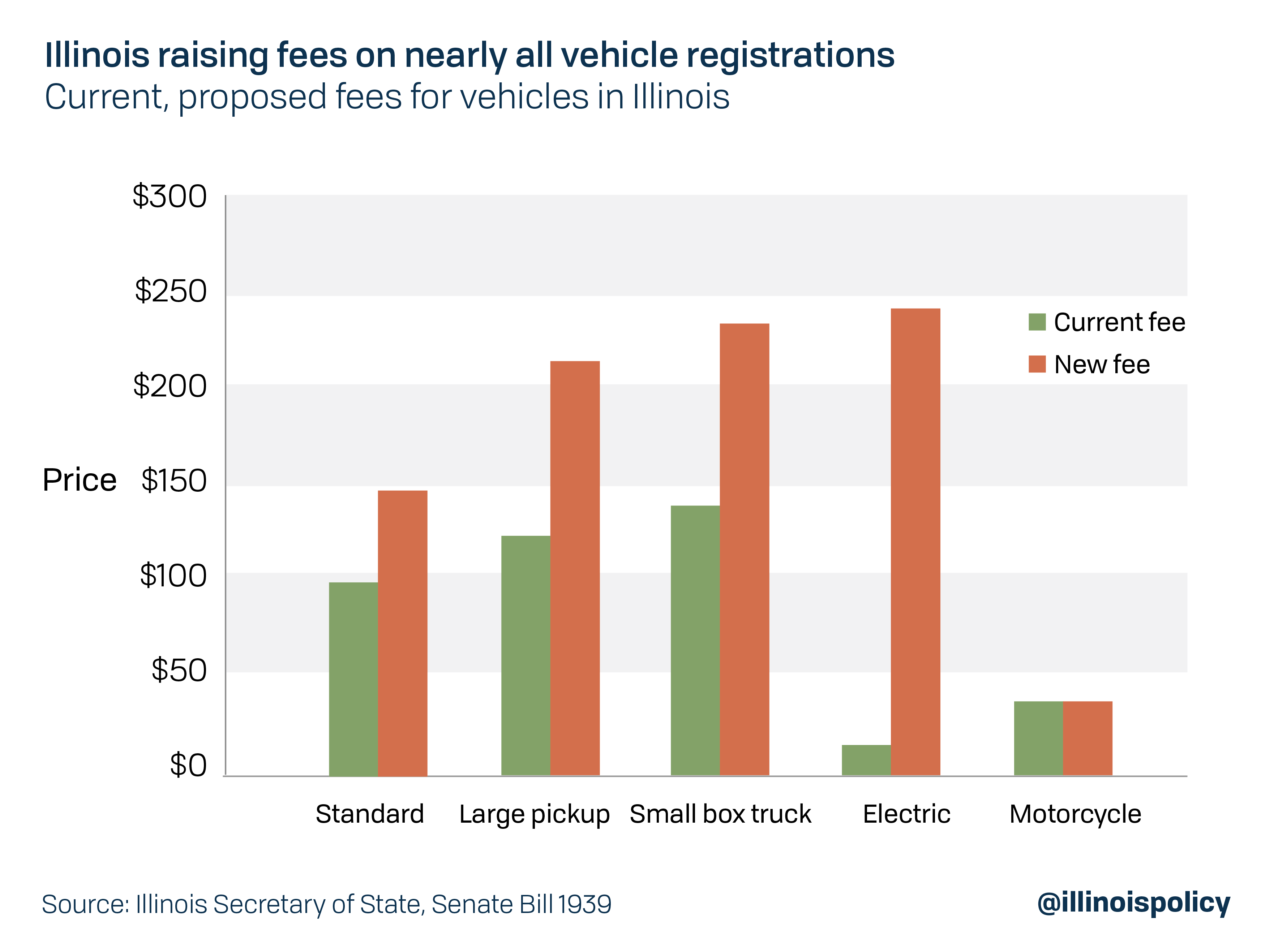

Socal Gas Rate Increase 2025 Melva Sosanna, Gas prices are displayed at a gas station on march 12, 2025 in chicago, illinois. Beginning july 1, the suspension of the state's grocery tax will end and an increase in the gas tax will take effect for the second time this year.

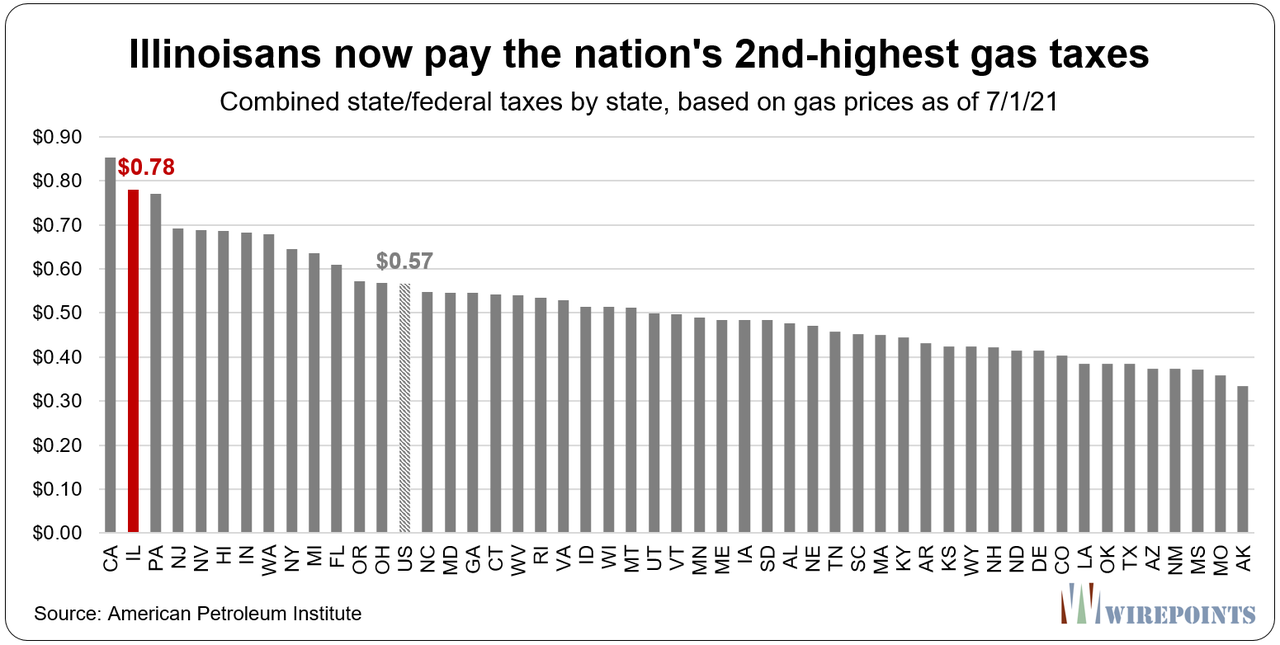

Higher Gas Prices Mean Higher Taxes Illinoisans Now Pay The Nation's, Corn plantings at 91.776 million acres, down 3% from 2025 but up slightly from the 91 million acres the u.s. The tax on diesel fuel will rise to 46.7 cents per gallon.

Pritzker signs bill doubling Illinois gas tax, Illinois consumers set to pay more for gas, groceries as tax relief measures expire. From january 1, 2025, through june 30, 2025, the rates are as follows:

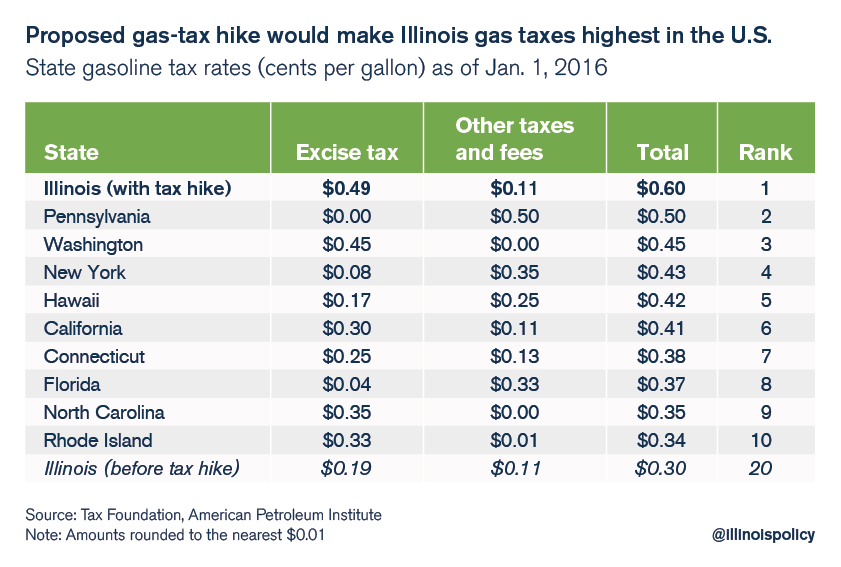

New bill would make Illinois gas taxes highest in the nation, The rates listed here are effective january 1, 2025, through june 30, 2025, for use on the quarterly ifta. Amanda vinicky | june 29, 2025 7:47 pm.

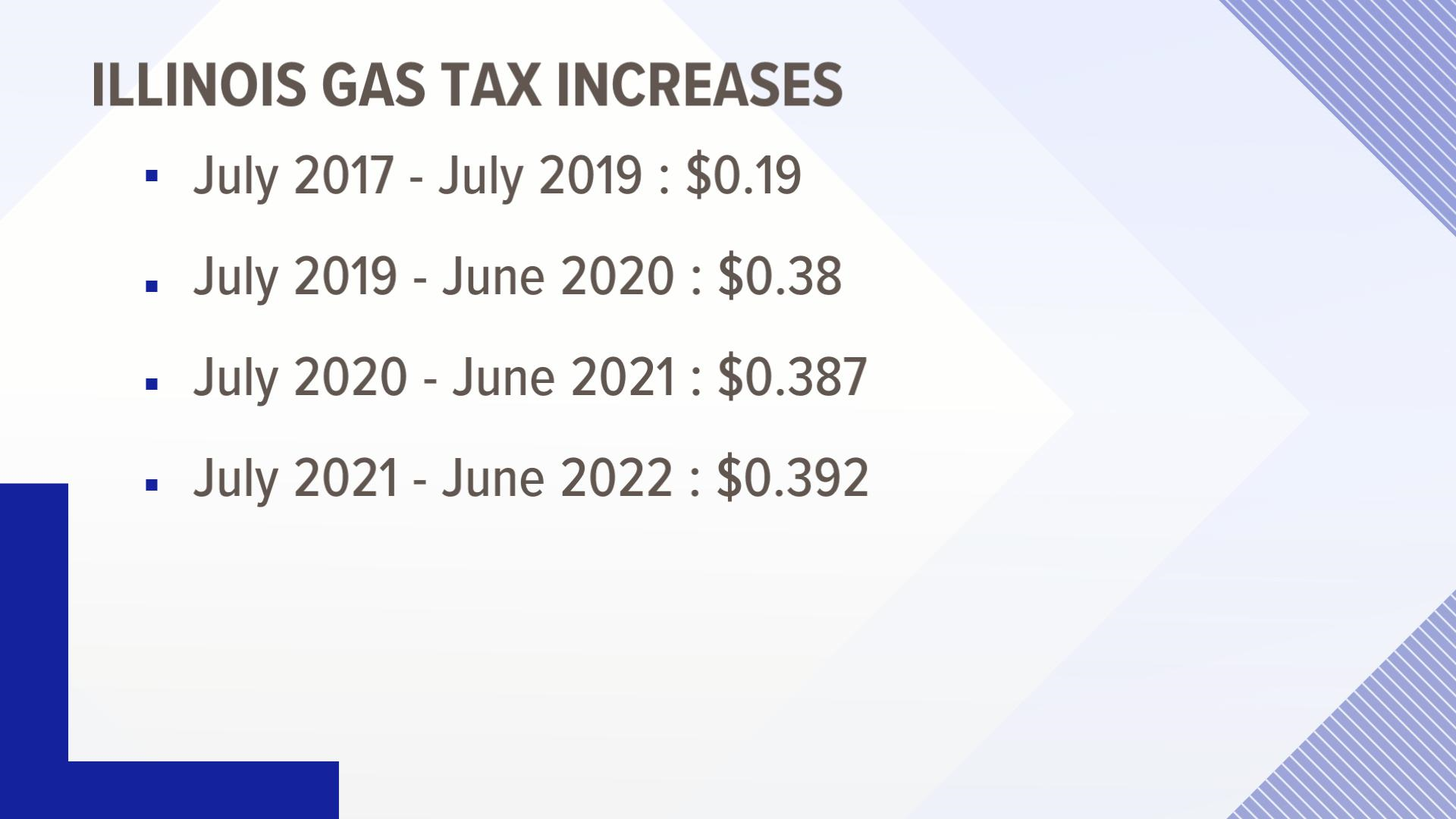

Illinois "gas tax" has increased every year since it was doubled in, Illinois has had automatic annual gas tax hikes since 2019 when gov. The motor fuel tax on gasoline, gasohol and compressed natural gas, meanwhile, will increase by 3.1 cents on july 1, to 45.4 cents per gallon.

July Brings Higher Gas Taxes, Cigarette Taxes, And More To Fund Road, As a result, illinois motorists will see a fuel tax increase of roughly 3.2 cents per gallon for gasoline in the new year, bringing the state’s total fuel tax on gasoline to 42.4 cents. Within the past two years, the tax was highest in.

New Illinois Gas Tax And Rising Demand Lead To Highest Prices In 7, Sales tax rate change summary, effective january 1, 2025. Illinois consumers set to pay more for gas, groceries as tax relief measures expire.

Illinois gas taxes increase by halfpercent YouTube, Corn plantings at 91.776 million acres, down 3% from 2025 but up slightly from the 91 million acres the u.s. The tax on diesel fuel will rise to 46.7 cents per gallon.

Illinois gas prices Fuel tax burden in state among highest in country, This tax is reported and paid by licensees under the international fuel tax agreement (ifta). As a result, illinois motorists will see a fuel tax increase of roughly 3.2 cents per gallon for gasoline in the new year, bringing the state’s total fuel tax on gasoline to 42.4 cents.

16 to march 15, the department determined the statewide average retail price per gallon of gasoline to be $2.7031.